Flexible KYC Onboarding and AML Compliance Solutions for Investment Banks

Verify investors in real time and accelerate your AML processes to meet compliance regulations.

HOW PLANETVERIFY HELPS INVESTMENT BANKS

Lower compliance costs

Leverage automation to streamline your processes and allow your team to focus on core business activities.

Automated Verification and Onboarding

Implement a consistent verification and onboarding process that reduces manual work, data entry, and human error.

Delight New Investors

New investors are reassured with a security-first, compliant, and on-brand onboarding experience.

Central Compliance Hub

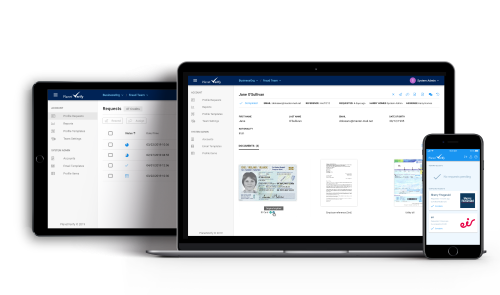

PlanetVerify acts as a central compliance hub where sensitive client documents and information is collected, verified, managed, and stored in a compliant manner.

Build Flexible and Automated KYC and AML Processes with PlanetVerify

- Automated onboarding and client verifications

- PEPs and sanctions screening

- GDPR-Compliant document collection and management

- Integrate with existing systems

- On-brand and automated client onboarding

Protect Against Financial Crime

Build a highly secure, compliant, and scalable KYC onboarding process with PlanetVerify to protect your company from money laundering, fraud, identity theft, and payment scams.

On-brand Client Onboarding

Deliver a professional and on-brand client onboarding experience that brings together verification, document collection, and personal data compliance.

PlanetVerify Consultation

SPEAK WITH OUR LEADERSHIP TEAM

Free 30 Minute Consultation

Speak with our solutions experts about optimizing your AML Compliance process with PlanetVerify.

Find a time on the PlanetVerify calendar to schedule your call today. We look forward to speaking with you soon!

THIS CONSULTATION IS PERFECT FOR:

- Companies who are still using legacy tools like email to collect sensitive customer documents.

- Companies who want to implement an automated customer verification process.

- Companies looking to improve their client onboarding experience.

- Companies looking to secure their internal processes and ensure data compliance.