In 2023, the FTC recorded over a million reports of identity theft totaling a loss of more than $10.3 billion. This rise in financial crime means companies have had to rapidly adapt their own AML compliance processes. As criminal tactics evolve, so too must the AML processes designed to keep the criminals out.

One particular area within the broader AML space that continues to take on a crucial role in the prevention of financial crime is ID&V software. These technologies have become essential in the ongoing battle against money laundering, providing robust solutions that adapt to ever-changing compliance requirements.

In this post, we will take a look at the important role ID&V software solutions play in helping companies meet compliance requirements and also examine some best practices, benefits, tips, and more.

What is ID&V Software?

ID&V software solutions are applications that automate the process of confirming a person is who they say they are. Typically, this verification occurs during an onboarding phase and popular identity verification methods include digital ID and document verification, biometric authentication, liveness checks, database checks, face-matching, and selfie-ID verification. An important part of AML regulations is that financial services companies and regulated businesses need to be able to confirm the identity of their customers and, as a result, it is vital that they establish a secure, compliant, and efficient ID&V process. Using manual or legacy verification methods is wide open to vulnerabilities and will not scale meaning ID&V software solutions have become a vital cog for companies in regulated industries.

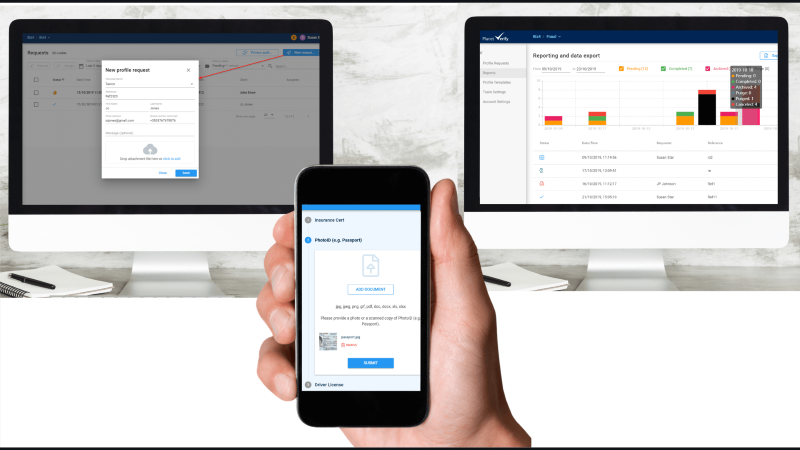

Another important factor to consider for any company weighing up ID&V software is the document and data collection part of the ID&V process. The leading ID&V software solutions should provide your company with a secure and GDPR compliant way to collect and store sensitive customer information and documents. These personal details and documents can then be used to verify the person’s identity and also cross check various databases to identify politically exposed and sanctioned persons or entities—mitigating the risks around money laundering, terrorist activity, and other financial crimes.

ID&V software is used by companies across many different industries including financial services, accountancy, insurance, fintech, wealth management, legal services, telecommunications, banking, and credit unions.

Benefits of ID&V Software

ID&V software has become one of the most indispensable ID verification tools for financial institutions and businesses striving to meet AML compliance requirements. By streamlining KYC onboarding, automating verification processes, and bolstering security measures, ID+V software significantly enhances AML compliance efforts. Some of the key benefits include:

1. Automation of manual and legacy processes: Leading ID&V software solutions help companies to automate their ID&V processes. One example might be companies still using email to onboard new customers by collecting sensitive documents and personal data. Email – used in this onboarding context – constitutes a high risk behavior that is wide open to fraud, data leaks and, from an internal process standpoint, is wildly inefficient and time-consuming. The leading solutions in this space, will help you automate data and document collection as well as verify customers in seconds.

2. Enhanced Security: ID&V software enhances security in a number of ways. At the most basic level, they can help companies ensure a new customer is who they say they are. But, additionally, ID&V software brings a number of other security benefits including minimizing the role of human intervention in the onboarding and KYC process which, in turn, reduces manual errors and reduces vulnerabilities associated with legacy or overly manual processes.

3. Better Customer Experience: The modern customer brings with them a certain set of expectations around security. As a result, equipping your company with a leading ID&V software solution which requires a new customer to undergo a thorough set of verifications and checks will actually go a long way to meeting customer expectations and shows how seriously your company takes the threat of financial crime. The best customer onboarding experience is still those that offer the least amount of friction and maintain on-brand messaging, but companies must also demonstrate their commitment to upkeep the highest possible levels of security. The leading ID&V solutions can help you deliver here on all fronts.

4. Scalability: The best-in-class ID&V software solutions are highly scalable. Whether you are onboarding hundreds or thousands of new customers per year, the best solutions will help you scale seamlessly and deliver a consistent ID&V and KYC onboarding process throughout.

5. Internal Efficiency: ID&V software will help your company to reduce manual tasks around onboarding and KYC enabling internal teams to focus their time and efforts on core business tasks.

6. Reporting: Keeping up with compliance reports can be time-consuming and arduous work. With the best-in-class ID&V software, you can simplify compliance report generation for regulatory bodies, ensuring timely and accurate submissions. Some solutions also allow for tailored verification processes to meet specific business needs and regulatory requirements.

7. Real-Time Verification: ID&V software can verify identities on the spot, helping companies onboard new customers in minutes—ensuring everyone from the customer to the internal teams experiences a smoother and more efficient onboarding process.

PlanetVerify’s ID&V Solution

Incorporating ID&V software into your AML compliance process can have major benefits. PlanetVerify provides companies with flexible AML solutions which include ID&V, PEPs and sanctions checks, secure document handling, automated onboarding, and GDPR compliance capabilities. If you would like to learn more about PlanetVerify please reach out today!